Exchange-traded funds finished Friday's session flat but posted strong gains for the week as the Dow Jones Industrial Average broke the psychologically key 9000 level for the first time since early January.

At market close the Dow added 24 to finish at 9093, while the Nasdaq Composite fell 8 to 1966. The S&P 500 gained 3 to 979. For a detailed rundown on Friday's trading session see our market story.

Oil prices finished the week above $68 a barrel, boosting shares of energy and oil ETFs. United States Oil Fund (USO) jumped 5.8% for the week, while Oil Service HOLDRS Trust (OIH) gained 6.6%.

With the Dow above 9000 and the S&P 500 enjoying its best two-week gain since March, it was mostly only leveraged ETFs that suffered significant losses on the week. However, a drop in the price of gold Friday -- just one day after the precious metal hit a six-week high -- didn't do much for gold ETFs. Market Vectors Gold Miners ETF (GDX) and iShares COMEX Gold Trust (IAU) each finished the week with a fractional loss.

This Week's Industry News

Emerging Global Advisors announced the launch of the Emerging Global Shares Dow Jones Emerging Markets Titans Fund (EEG) which seeks to track the performance of the Dow Jones Emerging Markets Titans Composite 100 Index. Fifteen emerging markets countries are represented in the index, giving investors a pure play on stocks in those economies, the company said. The ETF will charge an annual expense ratio of 0.75%.

The Financial Industry Regulatory Authority softened its stance on leveraged ETFs, saying in a podcast that these investment vehicles "can be appropriate if recommended as part of a sophisticated trading strategy that will be closely monitored by a financial professional. At times, this trading strategy might require a leveraged or inverse ETF to be held longer than one day." In June FINRA issued a warning to advisors about holding leveraged ETFs for longer than one day, as compounding causes them to stray from their underlying benchmarks over time.

Next Week's Notebook

Earnings and Conference Calls

Monday

A. H. Belo, Ace Limited, Alberto Culver, American River Bankshares, Buffalo Wild Wings, Cal-Maine Foods, Curtiss-Wright, Franklin Electric, GulfMark Offshore, Honeywell, International Coal Group, Owens & Minor, RadioShack, Rent-a-Center, Sohu.com, Trident Microsystems, Zoran

Tuesday

A.M. Castle, Advent Software, AMB Property, Amedisys, BE Aerospace, BP, Celanese, Ceradyne, Check Point Software Technologies, Chicago Bridge & Iron, Coach, Columbia Sportswear, Coventry Health Care, Deutsche Bank, Energizer, Fresh Del Monte Produce, Heidrick and Struggles, Landec, LCA-Vision, Luxottica, McKesson, Nash Finch, National Oilwell Varco, Norfolk Southern Corp., Office Depot, Panera Bread, Patriot Coal, PepsiAmericas, Questar, RenaissanceRe Holdings, Rockwell Automation, SeaBright Insurance Holdings, Silicon Storage Technology, Supervalu, Teva Pharmaceutical, Textron, Interpublic Group, McGraw Hill, Unisys, U.S. Steel, Valero Energy, Viacom, Western Digital, XL Capital

Wednesday

Acadia Realty Trust, Adolor, Advantest, Aetna, Aflac, Akamai, ArcelorMittal, Assurant, Banco Santander, BorgWarner, Brookfield Homes, Brookfield Properties, Cabot, Cadbury, CB Richard Ellis, CBIZ, Coca-Cola Enterprises, ConocoPhillips, Covance, Daimler, Equity One, Equity Residential, Express Scripts, FBR Capital Markets, Fiserv, FMC, General Dynamics, Hanesbrands, Hess, Hospira, Jones Apparel, Lazard, Lincoln National, Martha Stewart Living Omnimedia, MeadWestvaco, Medco Health Solutions, Meredith, Moody's, Penske Automotive Group, Portfolio Recovery Associates, Qwest, Royal Caribbean Cruises, Sanofi-Aventis, SAP, Sprint Nextel, Symantec, Taser, Teradyne, Scotts Miracle-Gro, Timberland, Thomas Weisel Partners, Time Warner Cabel, Time Warner, Trico Marine Services, Tyco Electronics, United Rentals, Visa, Watson Pharmaceuticals, Wyndham Worldwide

Thursday

Alcatel-Lucent, AmeriSourceBergen, Aon, Apache, Arch Chemicals, AstraZeneca, Automatic Data Processing, Avery Dennison, Avon, Barrick Gold, Becton, Dickinson, Brunswick Corp., Cabela's, Cablevision, Canadian Pacific Railway, CEC Entertainment, Cepheid, CGGVeritas, CH Energy Group, Charles & Colvard, Cigna, Colgate-Palmolive, Covidien, Cummins, Dolby Laboratories, Double Eagle Petroleum and Mining, Dow Chemical, Duke Realty, Eastman Kodak, Evergreen Solar, Expedia, ExxonMobil, First Solar, Franklin Resources, Genworth Financial, Goodyear Tire & Rubber, Helmerich & Payne, Horizon Financial, Ingram Micro, International Paper, Iron Mountain, Kellogg, Kimco Realty, Las Vegas Sands, Level 3 Communications, MarineMax, MasterCard, McAfee, MetLife, Monster Worldwide, Morningstar, Motorola, Mylan, Newell Rubbermaid, Noble Energy, NTT DoCoMo, NYSE Euronext, OfficeMax, Olympic Steel, Oppenheimer Holdings, Oshkosh Corp., Palomar Medical Technologies, Parker Hannifin, PerkinElmer, Pitney Bowes, Provident Financial Holdings, RealNetworks, Reed Elsevier, Regal Entertainment, Republic Airways, Republic Services, Revlon, Rockwell Collins, Sony, SourceForge, Taleo, Taylor Capital, Tennant, The Brinks Company, The Hanover Insurance Group, The Travelers Cos., Tyco International, Varian Semiconductor, Walt Disney, Waste Management, WisdomTree Investments, Wynn Resorts

Friday

Allergan, Anglogold Ashanti, AutoNation, Belo, Calpine, Chevron, Constellation Energy, DryShips, Eldorado Gold, HMS Holdings, ITT, Johnson Outdoors, Lafarge, MDC Holdings, NorthStar Realty Finance, Snap-on Inc., Washington Post Co., Weyerhaeuser

Economic Data

Monday

10:00 a.m. New Home sales

Tuesday

7:45 a.m. ICSC-Goldman Store Sales

9:00 a.m. Consumer Confidence

9:00 a.m. S&P/Case-Shiller Home Price Index

Wednesday

8:30 a.m. Durable Orders

10:30 a.m. Crude Inventories

2:00 p.m. Beige Book

Thursday

8:30 a.m. Initial Jobless Claims

10:30 a.m. EIA Natural Gas Report

Friday

8:30 a.m. GDP

9:45 a.m. Chicago PMI

A look at how the industry's most popular ETFs did on Friday:

10 Largest ETFs | Symbol | Current Price | Net Assets | Volume | Expense Ratio | 52 Week High | 3 Year Return |

| SPY | 97.86 | 63,739 | 153,678,812 | 0.090 | 130.7 | -5.63 |

| EFA | 49.26 | 29,392 | 15,432,526 | 0.340 | 67.37 | -5.11 |

| EEM | 35.4 | 28,449 | 49,253,525 | 0.720 | 43.16 | 7.33 |

| GLD | 93.41 | NA | 4,732,231 | 0.420 | 97.24 | 13.95 |

| IVV | 98.39 | 18,337 | 8,785,076 | 0.090 | 130.92 | -5.61 |

| QQQQ | 39.05 | 14,025 | 110,144,969 | 0.200 | 48.32 | NA |

| IWF | 43.67 | 9,479 | 2,402,457 | 0.200 | 55.45 | -2.06 |

| SHY | 83.7 | 7,044 | 969,766 | 0.150 | 85 | 5.39 |

| VTI | 49.39 | 10,258 | 1,639,727 | 0.070 | 65.56 | -4.75 |

| IWD | 50.44 | 7,068 | 2,337,692 | 0.200 | 70.64 | -9.07 |

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day.

This past month I presented TJX Companies to my Stock Club and they went ahead and bought a few shares for our portfolio. I do not personally own any shares of TJX Cos. (TJX) but do think it deserves a spot in this blog. TJX closed today (7/28/09) at $36.25, up $.35 or .97% on the day. Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

Then WHY would I be writing up a retail firm in this sort of awful environment? Well it turns out that as one might expect there are always some bright spots even in negative news. In fact, TJX has been bucking the trend and last month reported positive same store sales growth with a 4% same-store sales increase! It seems that customers are still seeking those 'name brands' normally found in more expensive chains but now being sold at TJ Maxx and elsewhere as part of 'close-outs'. Anyhow, that's my take on this apparently paradoxical retail report.

Colgate-Palmolive (CL) is definitely one of my favorite 'comfort stocks'. However, I wasn't very comfortable when they reported their

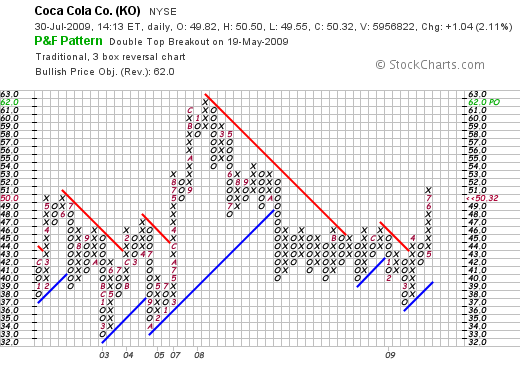

Colgate-Palmolive (CL) is definitely one of my favorite 'comfort stocks'. However, I wasn't very comfortable when they reported their  I went ahead and purchased 50 shares of Coca-Cola (KO), a slightly smaller position than my Colgate, at $50.39/share this morning.

I went ahead and purchased 50 shares of Coca-Cola (KO), a slightly smaller position than my Colgate, at $50.39/share this morning.

Forget the mantra about Pepsi's North American market's beverage and snack revenue being hurt, yada yada.

Forget the mantra about Pepsi's North American market's beverage and snack revenue being hurt, yada yada.

This is a case in which the technical indicators have tipped the scale vs. the fundamentals. I'm issuing a Buy recommendation for

This is a case in which the technical indicators have tipped the scale vs. the fundamentals. I'm issuing a Buy recommendation for  This morning Warren Buffett was interviewed and said he would be in favor of the federal government passing legislation for a

This morning Warren Buffett was interviewed and said he would be in favor of the federal government passing legislation for a  Infosys Technologies

Infosys Technologies

.gif)